BondBloxx 2023 Midyear Fixed Income Market Outlook

Highlights

- We believe fixed income investments will continue to present opportunities for investors during the second half of 2023.

- With the “income” back in fixed income, we see opportunities for investors to look beyond broad-based benchmarks to establish more precise exposures within the following fixed income asset classes:

- U.S. high yield bonds

- U.S. investment grade corporate bonds

- U.S. Treasuries

- Emerging market sovereign debt

- How investors position their portfolios within and across fixed income will continue to matter, as we expect elevated levels of total return performance dispersion to continue.

- Investors will likely have to navigate continued market volatility, reflecting the potential for persistent inflation and headwinds for the U.S. economy.

First Half 2023 Recap

The U.S. economy demonstrated remarkable resilience during the first half of 2023. Although the consensus view has repeatedly called for a recession to occur later this year, recent economic data is telling a different story. The U.S. labor markets remain strong and resilient, purchases of new homes increased to their fastest rate in more than one-year, durable goods orders topped consensus estimates, and consumer confidence reached its highest level since the beginning of 2022. This economic strength continues despite prominent regional bank failures that occurred in the spring, as well as tightening bank lending standards and market turmoil surrounding the debt ceiling talks.

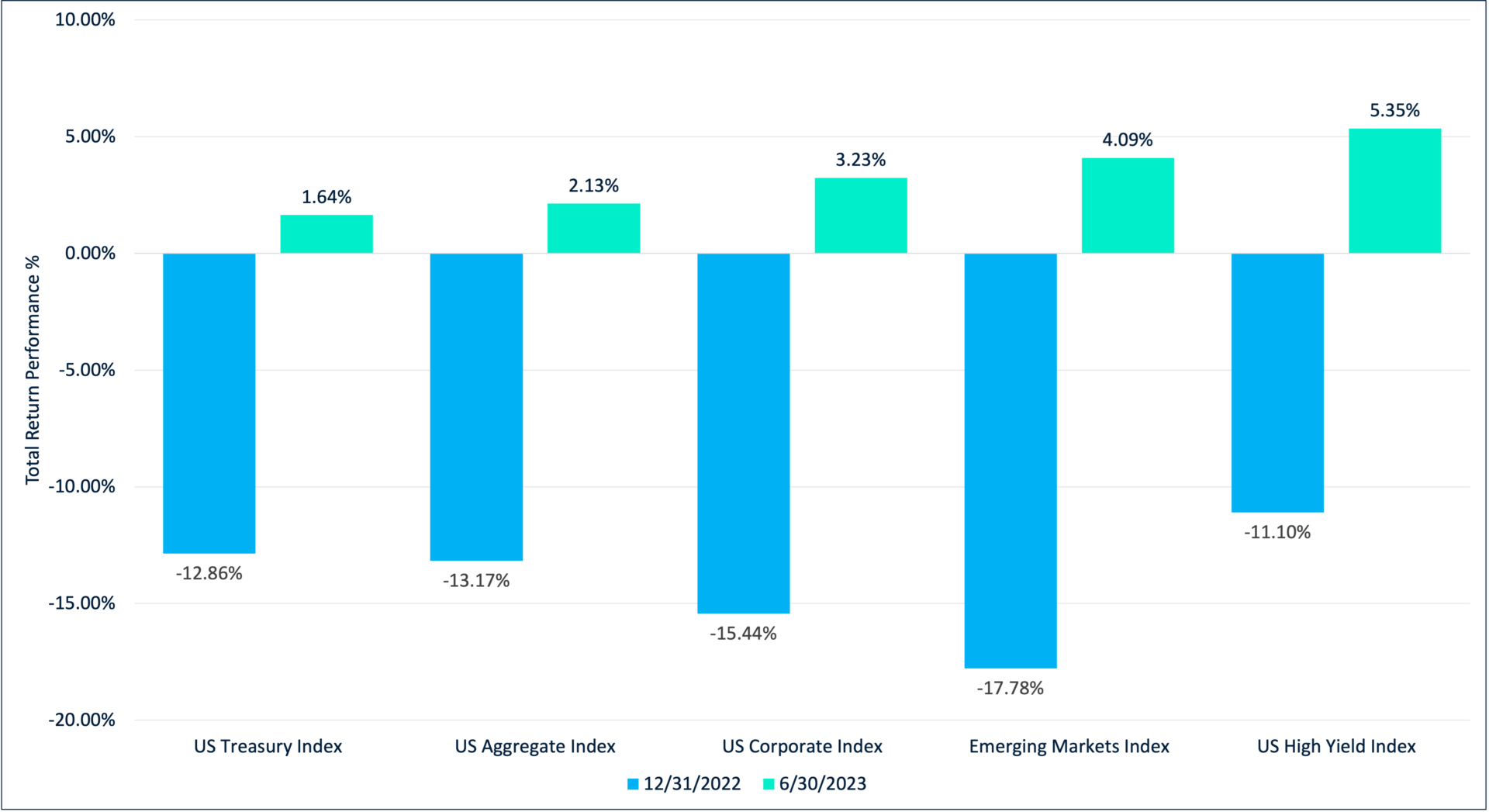

Total return performance rebounded across fixed income asset classes during the first half of 2023 (Figure 1). The U.S. high yield market experienced the strongest performance within fixed income, led by CCC-rated debt and the Consumer Cyclical industry sector. Further, both high yield and investment grade corporate balance sheets remain well-positioned to manage softening economic conditions, with average debt leverage near decade lows, and interest coverage metrics only slightly below all-time highs. U.S. Treasury performance also rebounded during the first half of 2023. In particular, the longest-dated maturities recovered from their worst performance in 100 years in 2022.

To rein in persistent inflation, the Fed has raised the federal funds rate a total of 10 times for a cumulative 500 basis points since the first quarter of 2022 – the fastest pace in four decades. Thus far in 2023, the Fed’s continued rate hike actions have been less aggressive, with 25 basis point hikes at each of the first three meetings. At their June meeting, the Fed struck a more hawkish tone despite pausing on a further rate increase, revising their year-end 2023 expectations for the Fed Funds rate higher to 5.50%-5.75%. This translates into the potential for at least two additional rate hikes over the remainder of 2023.

FIGURE 1

Year-to-Date 2023 versus Full-Year 2022 Comparative Performance

Source: ICE Data Services, J.P. Morgan, Bloomberg. Key: Blue represents returns from 1/1/2022 to 12/31/2022; Green represents returns from 1/1/2023 to 6/30/2023. See appendix for index definitions. An investment cannot be made in an index. Past performance does not guarantee future results.

Midyear 2023 Outlook

Although the consensus view continues to call for a U.S. recession in the upcoming months, we believe that there is a very limited chance of a recession through the end of 2023. Contrary to earlier predictions, the likelihood of a deep recession has significantly decreased, with the U.S. economy demonstrating resilience across multiple indicators. However, we will continue to monitor the cumulative effect of the Fed’s still unfinished rate hike campaign on the health of the U.S. economy.

Regarding the Fed’s hawkish stance on monetary policy, we believe the Fed is committed to getting inflation back down to their 2% target level. We also think the Fed will maintain an elevated federal funds rate longer than market consensus estimates, reflecting their ongoing efforts to manage persistently high inflation. Further, while the end state of the Fed’s rate increase campaign is not set in stone, it remains likely that the Fed will raise rates at least two more times in 2023.

Our constructive view on investment in selected areas of the fixed income market is supported by resilience that continues to be evident across a variety of U.S. economic indicators:

- The U.S. unemployment rate remains historically low at 3.6%, and the jobs market remains strong, despite softening of both metrics in recent months.

- Stability in inflation-adjusted retail sales statistics indicate that consumers are still spending.

- The recent rebound in new home sales suggests that the economy is withstanding higher mortgage rates.

- Corporate balance sheets appear to remain well-positioned to manage the potential for softening economic conditions.

- Debt maturities for high yield issuers are manageable over at least the next two years, while refinancing efforts so far this year have further reduced near-term maturities.

Fixed Income Outlook by Asset Class

U.S. High Yield Corporates

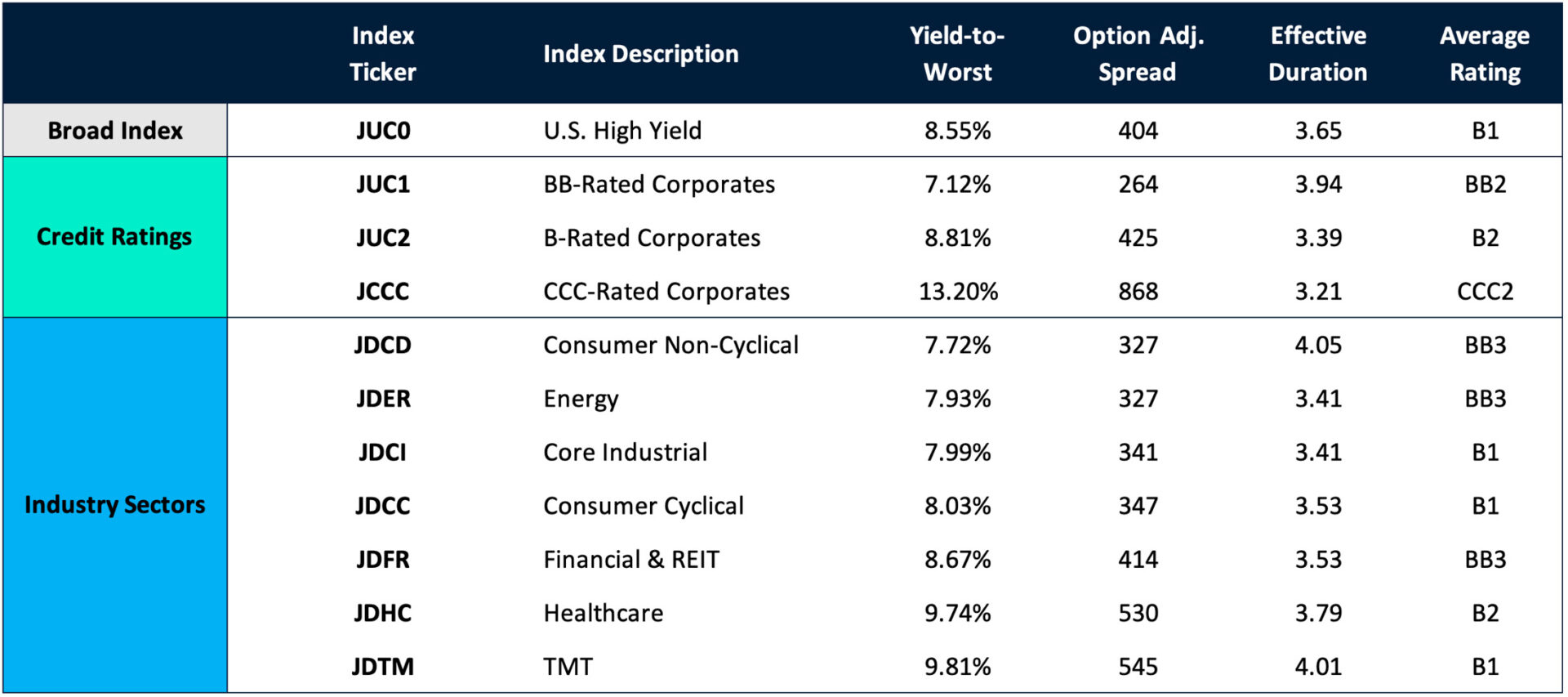

- Our view: The attractive yield levels available in U.S. high yield can provide higher income generation for investors, while also providing cushion for potential spread widening and lower expected volatility than equities (Figure 2).

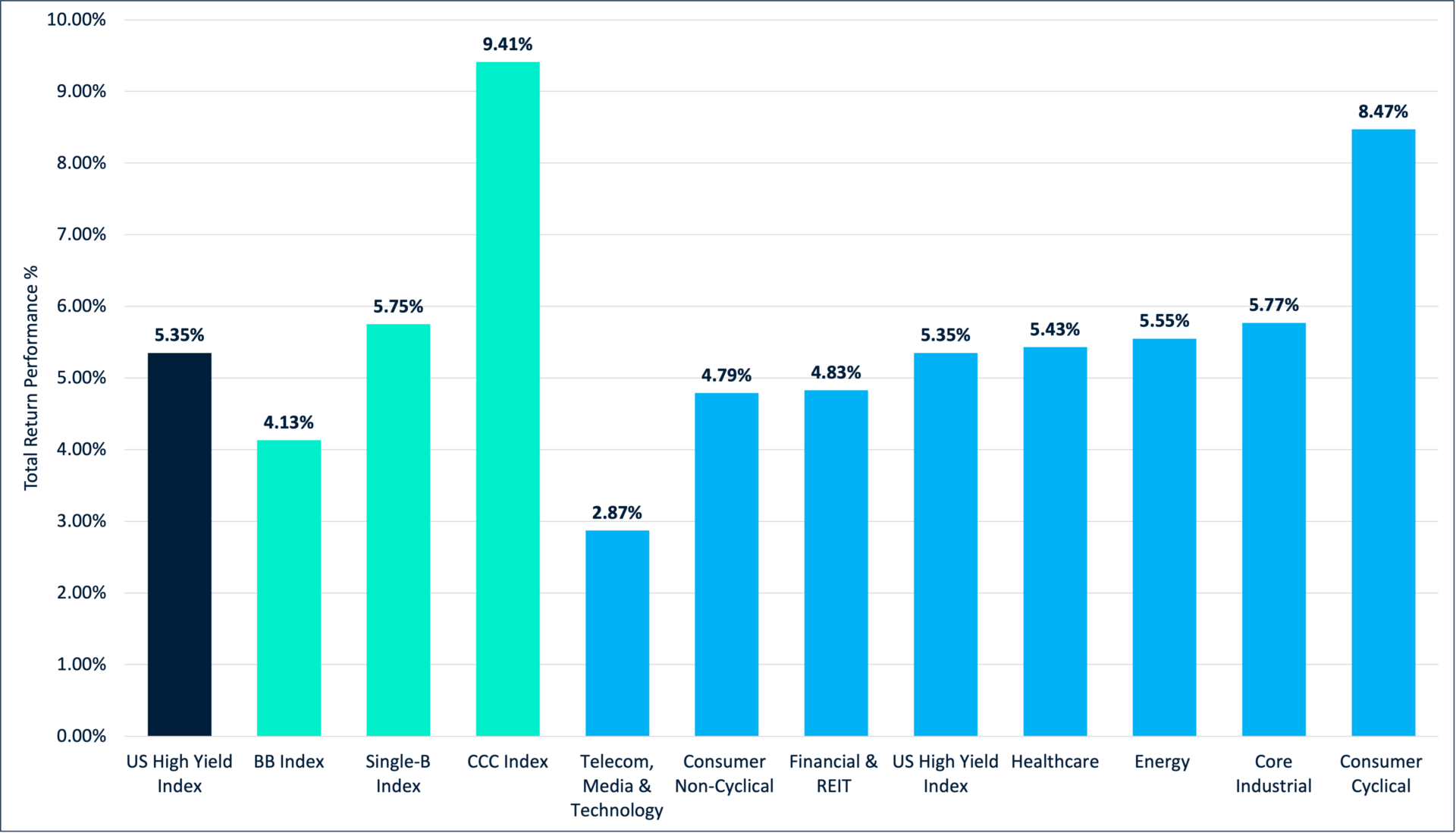

- Continued dispersion: As illustrated in Figure 3, the dispersion of returns across credit rating categories and industry sectors has continued during the first half of 2023. We believe this variance will continue, creating opportunities for outperformance versus broad high yield market indices, based upon credit quality and industry sector selection.

- Corporate fundamentals: High yield issuers entered 2023 from a position of relative strength and remain resilient going into the second half of the year. This stronger fundamental starting point is a clear differentiator of this economic cycle. High yield balance sheets remain well-positioned, with leverage statistics near pre-pandemic lows, and interest coverage measures near multi-year highs. The credit quality breakdown in high yield also remains better than prior to previous downcycles, with close to 50% of the high yield market rated BB. High yield issuers are actively addressing their near-term bond maturities, with refinancing the primary use of proceeds for the bulk of year-to-date high yield new issuance. Although corporate defaults could trend marginally higher over the remainder of the year, we project that the corporate default rate will end the year no higher than its long-term average.

- Supply of bonds: The low net supply of high yield bonds and continued rising stars means that the asset class could continue to contract in size, providing potential technical support for investors.

- Investment considerations:

- Credit rating category positioning can help investors increase or decrease their high yield risk exposure

- If investors are worried about weakening U.S. economic conditions and want to invest in the high yield rating category which exhibits the most balance sheet strength and the lowest historical default risk in high yield, they can consider BB’s

- If investors believe that the risk of a recession during the second half of 2023 is overblown and that corporate defaults will end 2023 at or below Moody’s long-term average, consider single-B’s

- If the U.S. is able to avoid a deep recession for the rest of the year, and a soft economic landing materializes going into 2024, consider CCC’s

- High yield industry sector positioning can help investors express their sector views

- If investors are interested in high yield industries that benefit from resilience in the U.S. consumer, consider the Consumer Cyclical and Consumer Non-Cyclical industries

- If investors are interested in the high yield industry with the strongest balance sheets and fundamentals, consider Energy

- If investors are interested in a high yield industry that has exhibited resilience in earnings and balance sheet strength, consider Core Industrials.

- Credit rating category positioning can help investors increase or decrease their high yield risk exposure

FIGURE 2

U.S. High Yield Index Characteristics

Source: ICE Data Services, as of 6/30/2023.

FIGURE 3

Year-to-date 2023 US High Yield Performance

Source: ICE Data Services, as of 6/30/2023.

Investment Grade Corporates

- Our view: Investment grade corporate bonds are attractive at yields more than double where they started in 2022, and reflect the continued fundamental strength exhibited by the asset class. We are especially constructive on the BBB rating category of the U.S. Corporate Index, reflecting its higher average coupon income and total return potential versus the broad corporate index.

- Corporate fundamentals: BBB corporate fundamentals remain solid, with leverage statistics below pre-pandemic levels, strong debt coverage ratios, and resilient earnings. Although there could be softening of BBB fundamentals later in 2023, we are not currently forecasting weakness that would result in a wave of fallen angels.

- Performance: On an annualized basis across the yield curve, BBB’s have outperformed broad U.S. corporate indices over the past 3, 5, 10 and 20 years.

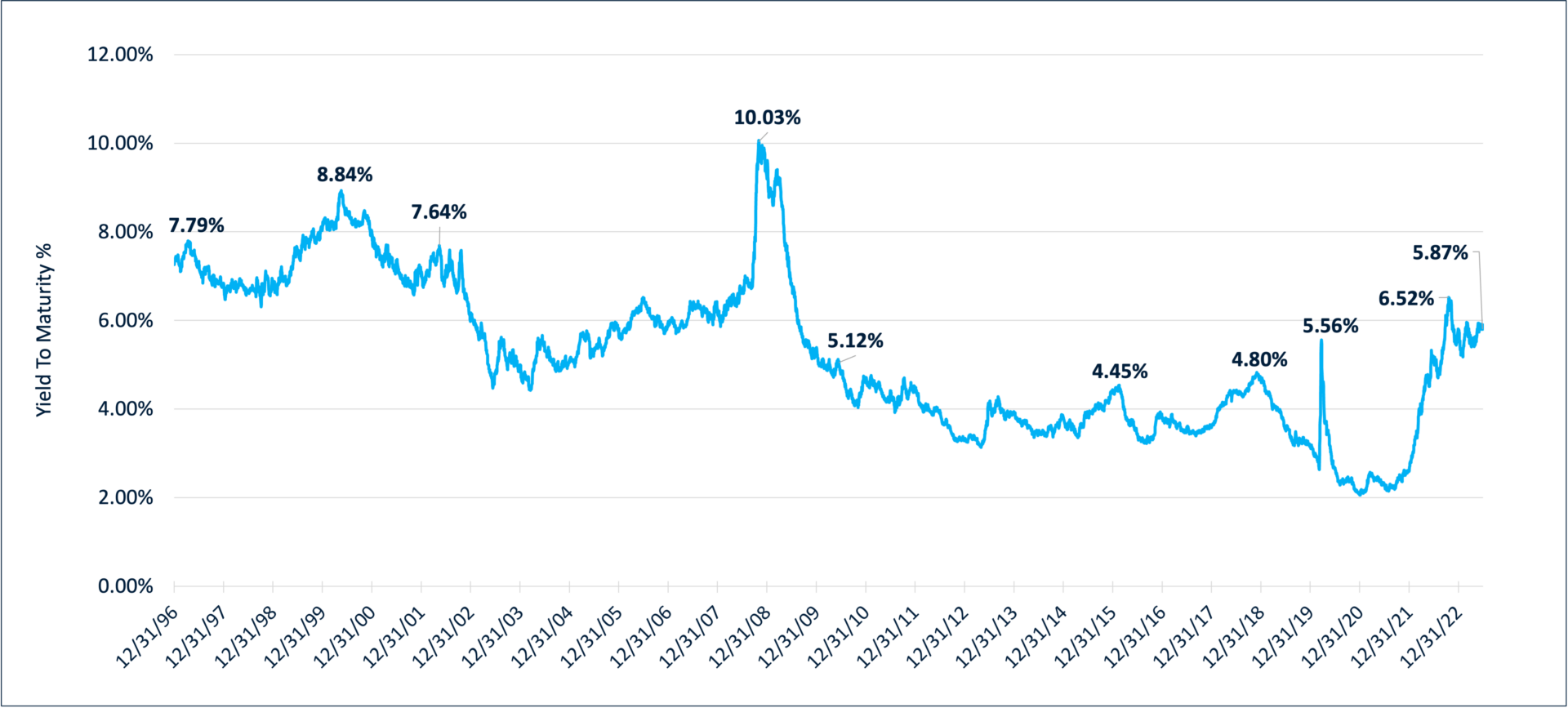

- Investment considerations: We believe investors are well-compensated for BBB risk at yields greater than 5.8%, yield levels not seen since the Great Financial Crisis (Figure 4).

FIGURE 4

Yield History of the ICE BofA BBB Corporate Index

Source: ICE Data Services, as of 6/30/2023. The ICE BofA BBB Corporate Index tracks the performance of US dollar-denominated BBB-rated corporate debt publicly issued in the US domestic market. Past performance is not indicative of future results. You cannot invest directly in an index.

U.S. Treasuries

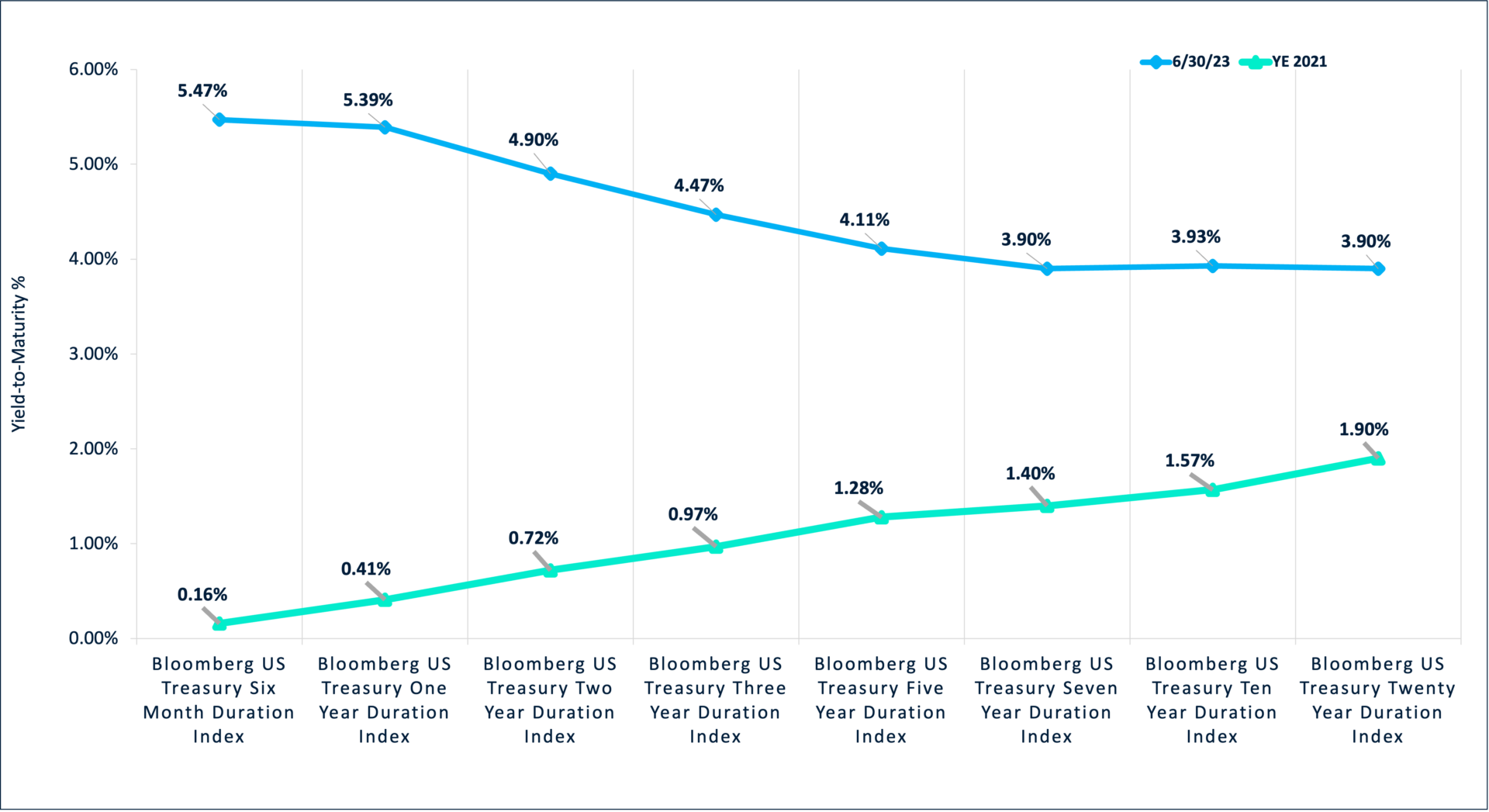

- Our view: We believe higher U.S. Treasury yields have increased their attractiveness to investors, with opportunities across the yield curve dependent upon specific investment goals and risk tolerance (Figure 5).

- Investment considerations:

- If investors are uncertain about what’s ahead, they can consider short duration U.S. Treasuries, with yields near the highest levels since 2007.

- The middle part of the U.S. Treasury curve can be considered by investors who believe the Fed is nearing the end of its rate hiking cycle and/or the U.S. economy is slowing.

- Longer-dated U.S. Treasuries can be considered by investors who anticipate a harder landing for the economy.

FIGURE 5

Bloomberg U.S. Treasury Target Duration Indices – Yield-to-Maturity

Source: Bloomberg, as of 6/30/2023. Past performance is not indicative of future results. You cannot invest directly in an index. The Bloomberg U.S. Treasury 10-Year Duration Indices are designed to target each respective duration using U.S Treasury securities. The indices are constructed using U.S. Treasury Notes/Bonds in Bloomberg’s US Treasury Index. Duration is the risk associated with the sensitivity of a bond’s price to a one percent change in interest rates. The higher the duration, the more sensitive a bond investment will be to changes in interest rates. Yield-to-maturity is the discount rate that equates the present value of a bond’s cash flows with its market price (including accrued interest).

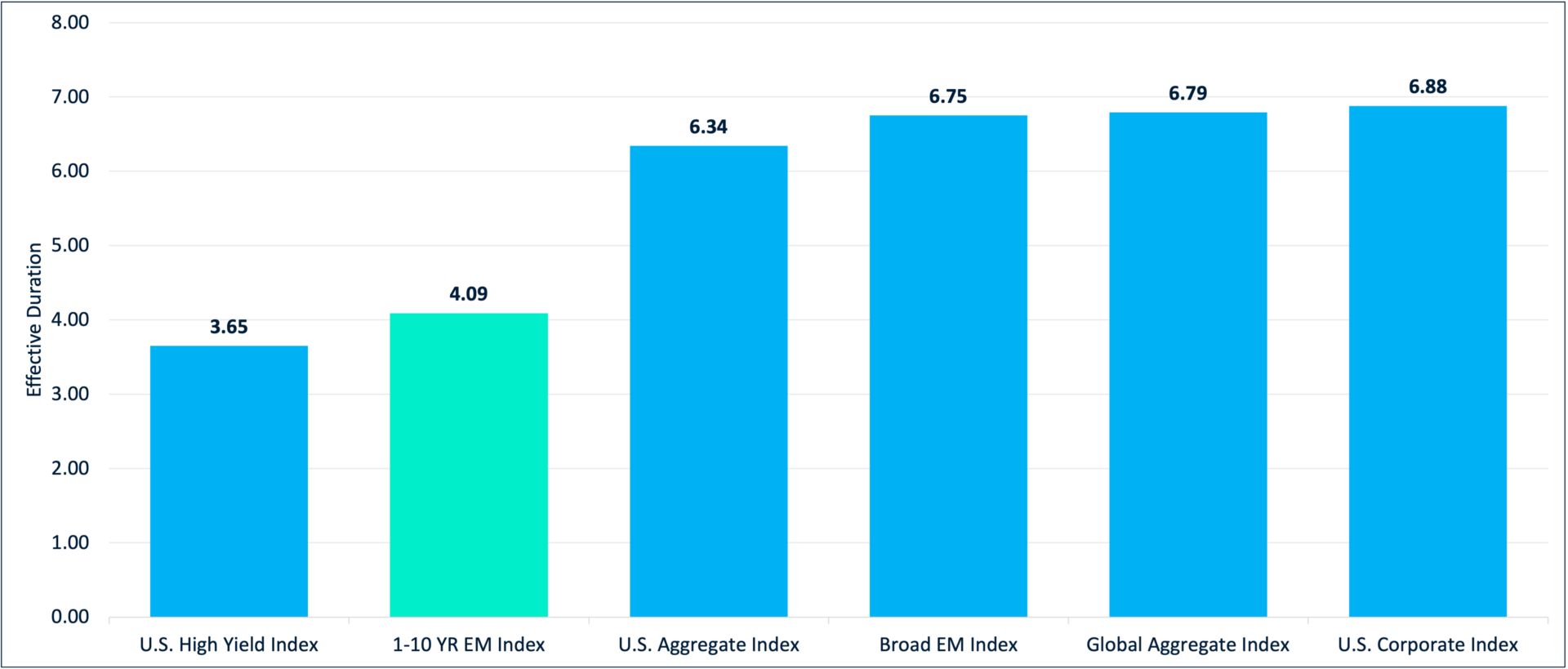

Emerging Markets Sovereign Debt

- Our view: We believe emerging markets sovereign debt could be poised for outperformance in fixed income during the second half of 2023, with the potential for spread tightening supported by resilient global economic conditions, a weaker U.S. dollar, and moderating inflation.

- Performance: EM was among the worst performing fixed income asset classes in 2022 largely driven by rates. EM performance recovered during the first half of 2023, outperforming both U.S. Treasury and investment grade corporate bond indices. It trailed the even stronger performance of the U.S. high yield market.

- Investment consideration: A shorter duration approach to EM investing continues to offer the opportunity to reduce both interest rate and spread duration risk in the asset class, while benefiting from its attractive starting yield in the low 10% range.

FIGURE 6

Duration Comparison of JP Morgan 1-10 year Emerging Markets Sovereign Debt Index Versus Broad Fixed Income Indices

Source: ICE Data Services, J.P. Morgan, Bloomberg, as of 6/30/2023. See appendix for index definitions.

Conclusion

In summary, we believe opportunities exist across the fixed income landscape; increased dispersion within asset classes means investors are well-served looking beyond the broad-based benchmarks to the ratings, sectors and duration categories benefiting from the current economic cycle and Fed actions.

Index Definitions:

- The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated, below investment grade-rated corporate debt publicly issued in the U.S. domestic market.

- The ICE BofA Broad Market Index measures the performance of U.S. dollar-denominated, investment grade debt securities, including U.S. Treasury notes and bonds, quasi-government securities, corporate securities, residential and commercial mortgage-backed securities and asset-backed securities.

- The ICE BofA U.S. Corporate Index tracks the performance of U.S. dollar-denominated investment grade rated corporate debt publicly issued in the U.S. domestic market.

- The ICE BofA U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market.

- The ICE BofA Current 10-year U.S. Treasury Index is a one-security index comprised of the most recently issued 10-year U.S. Treasury note.

- The ICE Diversified U.S. Cash Pay High Yield Rating Category Indices contain all securities in the ICE BofA U.S. Cash Pay High Yield Index, broken down by their rating categories: BB1-BB3, B1-B3, and CCC1-CCC3. Index constituents are capitalization-weighted, based on their current amount outstanding.

- The JP Morgan EMBI Global Diversified Index tracks total returns for traded external debt instruments in the emerging markets, including U.S. dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million.

- The J.P. Morgan 1-10 Year Emerging Markets Sovereign Index tracks liquid, U.S. dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi sovereign entities. The EMBIGDL 1-10 Index is based on the long-established J.P. Morgan EMBI Global Diversified Index and follows it methodology closely, but only includes securities with at least $1 billion in face amount outstanding and average life below 10 years.

- The Bloomberg U.S. Treasury Target Duration Indices are a suite of 8 indices designed to target a specific duration using US Treasury securities. The 8 durations targeted are 6 Month, 1 Year, 2 Year, 3 Year, 5 Year, 7 Year, 10 Year and 20 Year.

- The Bloomberg U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the US Treasury.

- The Bloomberg Global-Aggregate Total Return Index is a flagship measure of global investment grade debt from twenty-eight local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Disclosures:

This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The views expressed herein are subject to change and do not constitute investment advice or a recommendation regarding any specific product or security. Past performance is no guarantee of future results. Investing involves risk including possible loss of principal.

Investments in fixed income securities are subject to risks including but not limited to interest rate risk, credit risk and market risk, each of which could have a negative impact on the value of the holding. Credit risk refers to the possibility that the issuer or other obligor of a security will not be able or willing to make payments of interest and principal when due. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply.

Carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus or, if available, the summary prospectus, which may be obtained by visiting this link. Read the prospectus carefully before investing.

Distributor: Foreside Fund Services, LLC.