BondBloxx 2023 Fixed Income Market Outlook

Highlights

- 2022 was a historic year for losses in the U.S. financial markets1

- In 2023, market volatility will likely persist due to continued headwinds faced by the U.S. economy

- Fixed income asset classes have the potential to deliver better total return performance in 2023

- How investors are positioned in their fixed income portfolios matters, as we expect continued elevated levels of performance dispersion within and across fixed income asset classes

2022 Recap

Accelerating inflation, Russia’s invasion of Ukraine, and aggressive monetary tightening policies by the Federal Reserve were the major contributors to one of largest yearly declines in decades for the U.S. financial markets.2 Major U.S. stock indices moved decidedly into bear market territory, and the fixed income markets, which typically provide diversification against declining equity prices, also generated negative returns as interest rates rose sharply.

Price increases throughout the U.S. economy weighed on both the equity and fixed income markets, with inflation being the biggest issue faced by corporations, consumers, and the Federal Reserve.3 U.S. inflation, as measured by the Consumer Price Index (CPI), reached a forty-year high of 9.1% during the second quarter of 2022,4 prompting the Fed to acknowledge it misread the inflationary environment which it previously considered transitory.

The Fed has since accelerated its efforts to rein in inflation with a campaign to boost interest rates, raising the federal funds target rate range to 4.25%-4.50% by December, from 0.25%-0.50% at the beginning of the year5. The Fed’s actions and its continued hawkish commentary regarding its rate-hike campaign caused significant volatility in the financial markets as the risk of recession rose and investors turned bearish.

2023 Outlook

In the near term, risks remain that equities and credit markets could decline further, extending the bear market in terms of magnitude and duration. The Fed has made it clear that it intends to raise rates until inflation is back down to its 2% target level,6 which means that quantitative tightening could continue through the first quarter of 2023. The U.S. jobs market remains strong and the low unemployment rate7 remains supportive of Chairman Powell’s hawkish stance on monetary policy. While the end state of the Fed’s rate increase campaign is not set in stone, it remains likely that the Fed will get the target rate to around 5% by mid-year, or somewhere between 4.75%-5.25%. This translates into another 50 basis points of tightening from current levels.

With lower-than-expected CPI prints in both October and November, there are signs that inflation may be peaking, especially if we continue to see lower CPI prints in the coming months. If sustained, this could provide a foundation for the U.S. financial markets to further stabilize and recover. However, as Chairman Powell indicated in recent remarks, the path ahead for inflation remains highly uncertain, and it will take more evidence to determine that the downward trend in inflation is continuing.8

Fixed income asset classes have the potential to deliver better total return performance in 2023, after a year of negative returns that reset valuations to levels that appear more attractive,9 especially if investors have a longer-term time horizon. Positive market momentum started in October and November, as risk markets rallied in connection with signs that inflation was starting to decline, thereby enabling investors to look beyond peak interest rates.10 However, we think market volatility will likely persist considering the headwinds the U.S. economy continues to face. It will matter how investors are positioned in their fixed income portfolios, as we expect an elevated level of performance dispersion to continue in 2023. Capitalizing on the potential for this variability can create opportunities for outperformance within and across fixed income asset classes.

Fixed Income Outlook by Asset Class

U.S. Treasuries

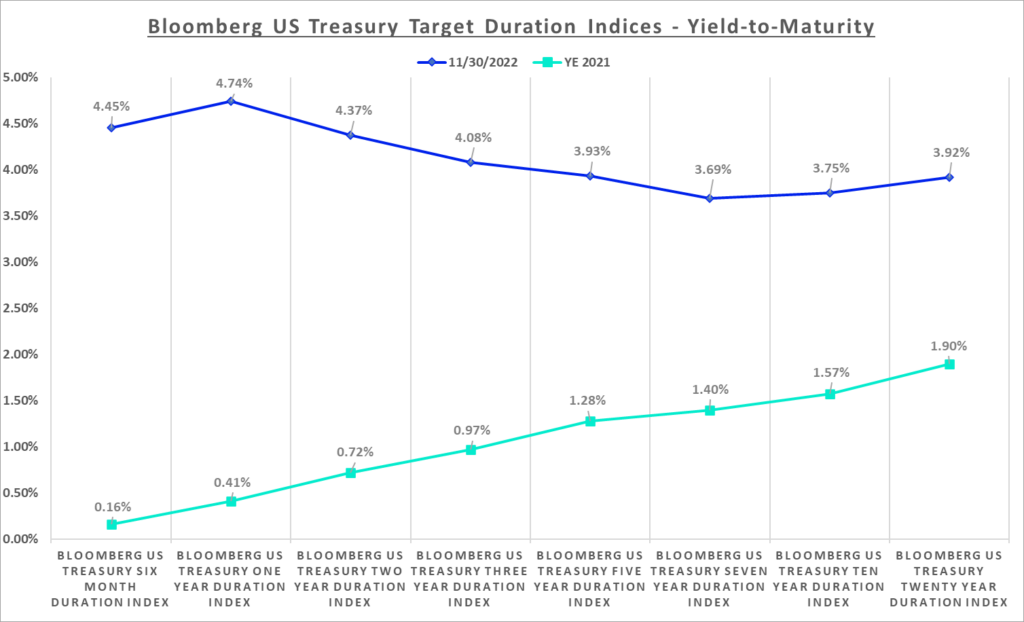

- Reflecting the Fed’s campaign of rate hikes throughout 2022, yields have risen sharply in U.S. Treasuries, and investors should consider a higher allocation to the asset class (Figure 1)

- Yields in the short end of over 4% appear compelling, with low price risk and zero credit risk

- According to a survey done by the Philadelphia Federal Reserve, more people expect a recession in 2023 than at any time in the last fifty years11

- In the event of a recession, the Fed could potentially cut rates in the second half of 2023, offering investors potential capital gains on their U.S. Treasury positions as rates fall

- Longer duration U.S. Treasuries could provide outperformance potential in anticipation of the downward policy pivot by the FedFigure 1

Source: Bloomberg, as of 11/30/2022 Past performance is not indicative of future results. You cannot invest directly in an index. The Bloomberg U.S. Treasury 10-Year Duration Indices are designed to target each respective duration using U.S Treasury securities. The indices are constructed using U.S. Treasury Notes/Bonds in Bloomberg’s US Treasury Index. Duration is the risk associated with the sensitivity of a bond’s price to a one percent change in interest rates. The higher the duration, the more sensitive a bond investment will be to changes in interest rates. Yield to maturity is the discount rate that equates the present value of a bond’s cash flows with its market price (including accrued interest).

Source: Bloomberg, as of 11/30/2022 Past performance is not indicative of future results. You cannot invest directly in an index. The Bloomberg U.S. Treasury 10-Year Duration Indices are designed to target each respective duration using U.S Treasury securities. The indices are constructed using U.S. Treasury Notes/Bonds in Bloomberg’s US Treasury Index. Duration is the risk associated with the sensitivity of a bond’s price to a one percent change in interest rates. The higher the duration, the more sensitive a bond investment will be to changes in interest rates. Yield to maturity is the discount rate that equates the present value of a bond’s cash flows with its market price (including accrued interest).

Investment Grade Corporates

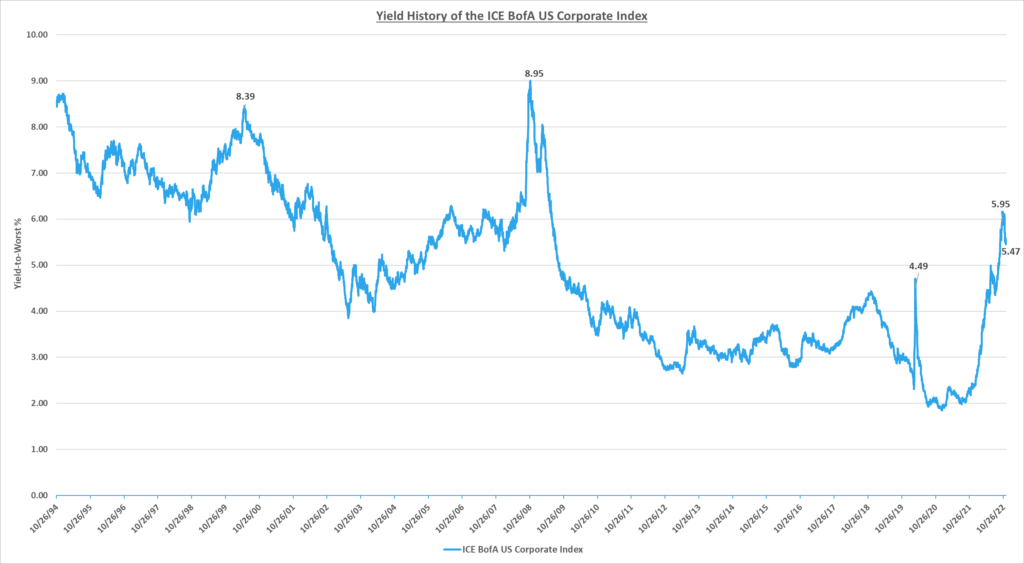

- Investors are well-compensated for investment-grade corporate risk at yields of over 5%, levels not seen since the Great Financial Crisis (Figure 2)

- Corporate fundamentals remain solid, with leverage statistics still below pre-pandemic levels, strong debt coverage ratios, and resilient earnings12

- Although there could be softening of investment grade fundamentals in 2023, we are not currently forecasting weakness that would result in a wave of fallen angelsFigure 2

Source: ICE Data Services, as of 11/30/2022 The ICE BofA US Corporate Index tracks the performance of US dollar-denominated investment grade rated corporate debt publicly issued in the US domestic market. Past performance is not indicative of future results. You cannot invest directly in an index.

Source: ICE Data Services, as of 11/30/2022 The ICE BofA US Corporate Index tracks the performance of US dollar-denominated investment grade rated corporate debt publicly issued in the US domestic market. Past performance is not indicative of future results. You cannot invest directly in an index.

High Yield Corporates

- Fundamentals could become more challenged for high yield in 2023, especially at the lowest end of the credit quality spectrum

- Despite the potential for spread widening if the U.S. heads into a recession, we believe that the asset class is expected to generate positive total return performance in 2023, reflecting the higher coupon income

- Although corporate defaults could trend higher over the next year, we project that corporate defaults will remain below their long-term average

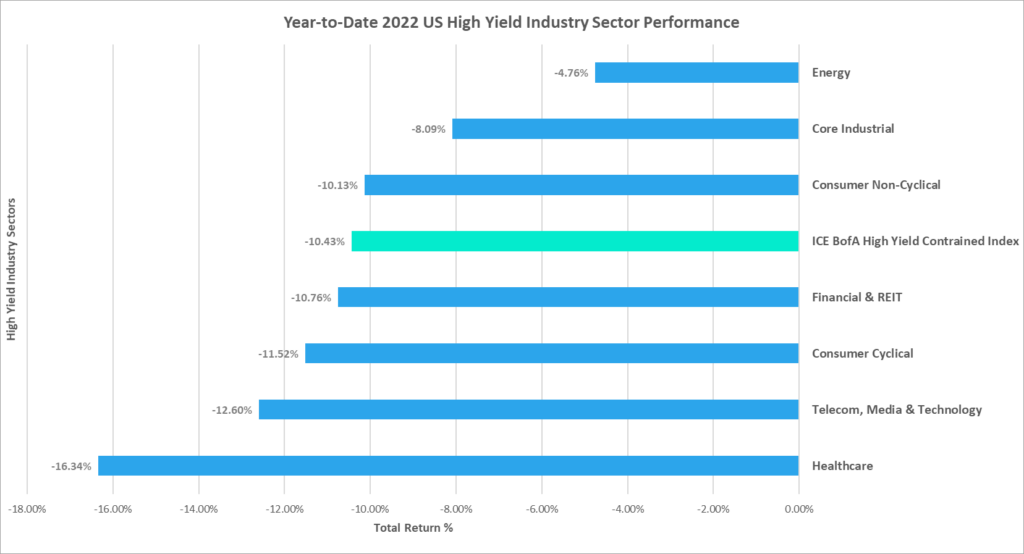

- Our key investment thesis is that the dispersion of returns across industry sectors and credit rating categories will remain elevated, creating opportunities for outperformance based on sector and credit quality selection; the wide dispersion year-to-date is shown in Figure 3

- Reflecting the potential for a recession, we recommend investors overweight the higher quality segments of the credit rating spectrum, rated BB and single-B, and underweight CCC’s

- At current spread and yield levels, we consider single-B’s the “Goldilocks” of high yield, as these companies are less rate-sensitive than BB’s, have higher credit quality with less idiosyncratic risk than CCC’s, and offer a yield/spread pickup versus both BB’s and the broad high yield index

- Industry sectors we favor include:

- Energy, reflecting the healthy cash flows these predominantly BB-rated companies are generating as well as their continued focus on de-leveraging;

- Core Industrial, reflecting the still-strong balance sheets and resilience in earnings that has been exhibited by many of the underlying companies in this sector

- Industry sectors we recommend underweighting:

- Healthcare: despite the higher yield available in the Healthcare industry sector, we would still recommend that investors underweight this sector, reflecting the potential for continued fundamental deterioration and downgrades

Figure 3 Source: ICE Data Services, as of 11/30/2022

Source: ICE Data Services, as of 11/30/2022

High Yield Loans

- Weakening fundamentals and the potential for a recession in 2023 will negatively impact high yield loan issuers, translating into wider loan spreads, ratings downgrades, and higher defaults

- Considering that the average loan coupon currently surpasses the average coupon for high yield bonds for the first time on record, reflecting the immediate transmission of higher rates on high yield loans, loan-only issuers are facing higher borrowing costs than their high yield peers13

- Credit rating trends for leveraged loans include a high percentage that are rated B3 or lower,14 a category more susceptible to further deterioration with weakening economic conditions

- Positively, we believe the maturity schedule for high yield loans appears manageable in 2023 and 2024, giving these issuers some runway to manage their balance sheets

Emerging Markets Sovereign Debt

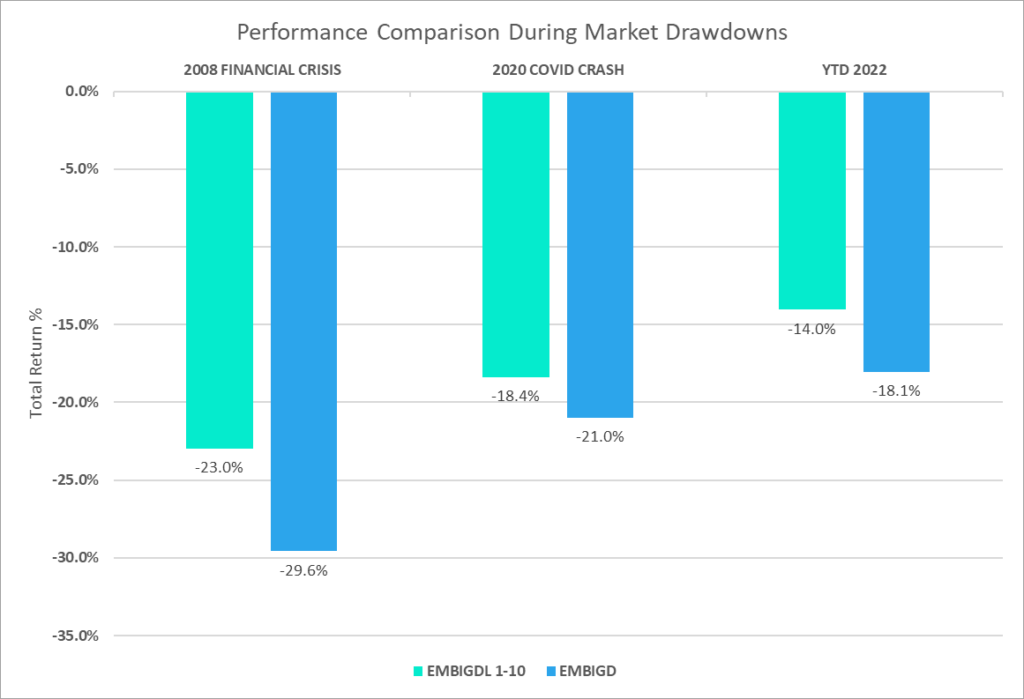

- Although emerging markets (EM) debt was among the worst performing fixed income asset classes in 2022 (Figure 4), the negative total return performance was largely rates-driven due to their long duration profile

- The asset class may be further away from a sustained recovery than other fixed income sectors, as further weakness in global economic conditions could have an amplified adverse effect on EM

- Credit spreads could continue to widen in EM during 2023 reflecting the impact of this continued global economic weakness

- Tighter financial conditions could also continue to negatively impact the asset class, highlighting vulnerabilities for countries that need to refinance their deficits at materially higher borrowing costs

- A shorter duration approach to EM investing continues to be our recommendation to reduce both interest rate and spread duration risk, as a shorter duration approach has outperformed during historical market drawdowns (Figure 4)

Figure 4 Source: J.P. Morgan, as of 11/30/2022. A market drawdown is a peak-to-trough decline during a specific investment period. The blue represents the JP Morgan EMBI Global Diversified Index (EMBIGD), which tracks total returns for traded external debt instruments in the emerging markets, including US dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million. The green represents the J.P. Morgan 1-10 Year Emerging Markets Sovereign Index (EMBIGDL 1-10), which tracks liquid, US dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi sovereign entities. The EMBIGDL 1-10 Index is based on the long-established J.P. Morgan EMBI Global Diversified Index and follows it methodology closely, but only includes securities with at least $1 billion in face amount outstanding and average life below 10 years.

Source: J.P. Morgan, as of 11/30/2022. A market drawdown is a peak-to-trough decline during a specific investment period. The blue represents the JP Morgan EMBI Global Diversified Index (EMBIGD), which tracks total returns for traded external debt instruments in the emerging markets, including US dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million. The green represents the J.P. Morgan 1-10 Year Emerging Markets Sovereign Index (EMBIGDL 1-10), which tracks liquid, US dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi sovereign entities. The EMBIGDL 1-10 Index is based on the long-established J.P. Morgan EMBI Global Diversified Index and follows it methodology closely, but only includes securities with at least $1 billion in face amount outstanding and average life below 10 years.

- 1 Source: Bloomberg

- 2 Source: Bloomberg

- 3 Source: Bloomberg

- 4 Source: Bloomberg, Bureau of Labor Statistics

- 5 Source: Bloomberg

- 6 Source: Federalreserve.gov/cbdc-public-comments.htm

- 7 Source: Bureau of Labor Statistics, as of 12/01/2022

- 8 Source: Dallas Fed Global Perspectives Conference, 11/28/2022

- 9 Source: Bloomberg

- 10 Source: ICE Data Services, Bloomberg

- 11 Source: Federal Reserve Bank of Philadelphia, as of 11/14/22

- 12 Source: J.P. Morgan

- 13 Source: J.P. Morgan

- 14 Source: J.P. Morgan

This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The views expressed herein are subject to change and do not constitute investment advice or a recommendation regarding any specific product or security. Past performance is no guarantee of future results. Investing involves risk including possible loss of principal.

Investments in fixed income securities are subject to risks including but not limited to interest rate risk, credit risk and market risk, each of which could have a negative impact on the value of the holding. Credit risk refers to the possibility that the issuer or other obligor of a security will not be able or willing to make payments of interest and principal when due. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply.

Carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus or, if available, the summary prospectus, which may be obtained by visiting (insert link). Read the prospectus carefully before investing.

Distributor: Foreside Fund Services, LLC.