Why Precision Will Matter for Bond Investors in 2024: BondBloxx Fixed Income Market Outlook

December 13, 2023

Highlights

- We believe now is the time for investors to increase their allocation to fixed income; we expect attractive forward returns in the coming year, as the Federal Reserve (“Fed”) is near the end of its rate hiking cycle.

- Within fixed income, we believe investors will need to look beyond broad-based benchmarks to establish more precise exposures as a way to seek outperformance.

- Specific strategies we view as compelling for the coming year include:

- High yield corporates – to seek attractive income as well as total return outperformance potential from tactical credit quality and industry sector selection

- BBB corporates – to take advantage of this rating category’s strong fundamentals as well as yield levels not seen in 15 years

- Short-term U.S. Treasuries – to potentially generate higher income, manage cash positions, and maintain liquidity

- Intermediate term U.S. Treasuries – to capture attractive total return potential considering the possible end to the Fed rate hike cycle, a slowing U.S. economy, and a normalization of the yield curve

- Shorter-duration emerging markets sovereign debt – to reduce both interest rate and spread duration risk while benefiting from attractive yields and total return potential

2023 Recap

The U.S. economy demonstrated remarkable resilience throughout 2023. Despite persistent expectations for a second-half recession driven by inflation and higher borrowing costs, economic indicators consistently outperformed projections. A notable example: the U.S. economy grew over 5% in the third quarter of 2023, the fastest expansion in nearly two years. A significant contributor to the economy’s ongoing resilience has been the enduring strength of the U.S. labor market, which fueled continued household spending and caused businesses to restock to meet strong demand.

Inflation levels eased through most of 2023, allowing the Federal Reserve to halt further rate increases at its July and September 2023 meetings as the U.S. economy continued to absorb prior adjustments. However, with recent inflation data still above the Fed’s 2% target, hovering in the low-to-mid 3% range for headline Consumer Price Index (CPI), the Fed could potentially raise rates again if progress in controlling inflation should stall.

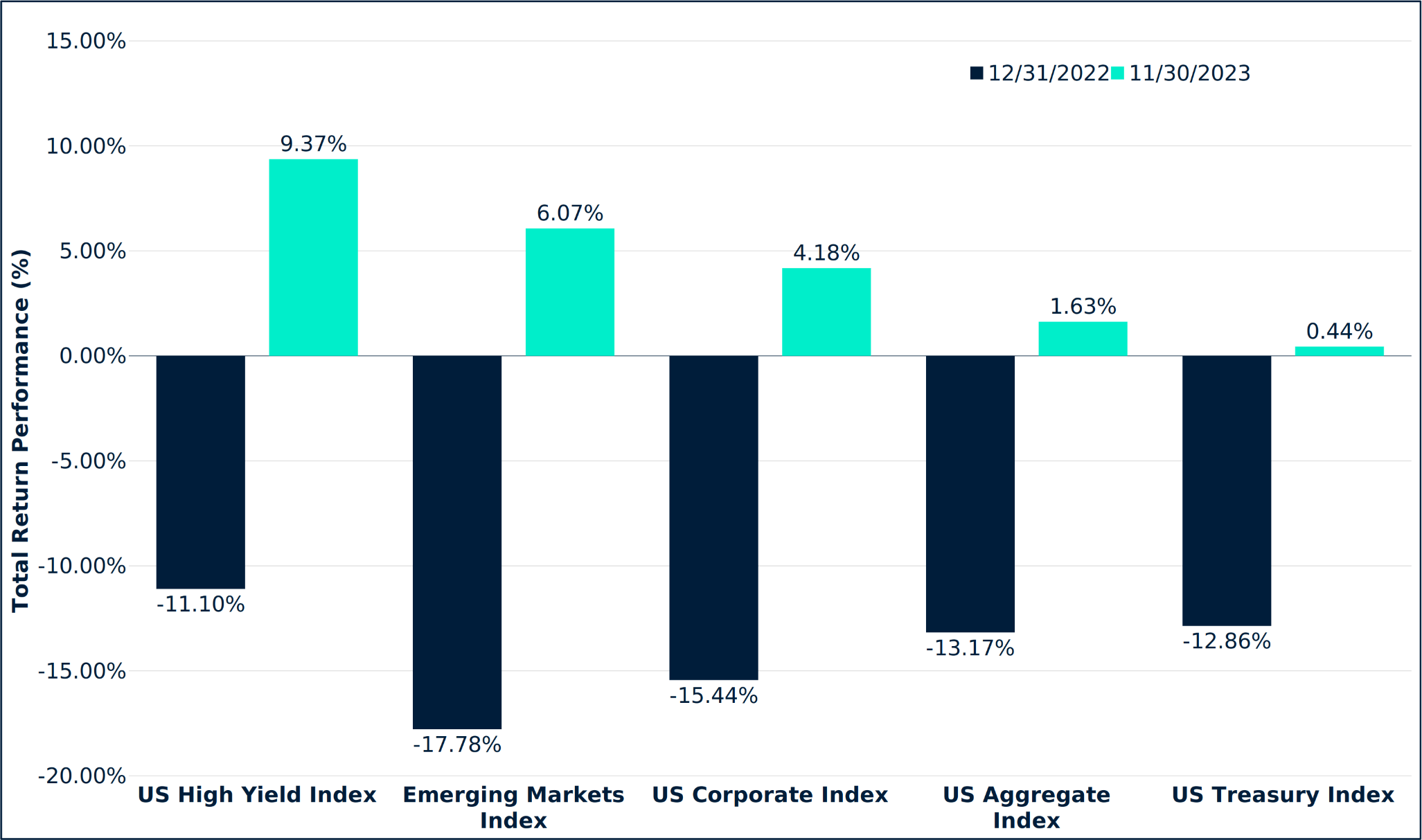

Total return performance returned to positive in 2023 for most segments of the fixed income market, a welcome change from last year’s outlier year of widespread U.S. financial market losses. The U.S. high yield market experienced the best performance among broad fixed income asset classes for the second year in a row, outperforming the U.S. Aggregate, U.S. Treasuries, investment grade corporates, and emerging markets sovereign debt (Figure 1). High yield performance was led by CCC-rated bonds and the Consumer Cyclical industry sector.

FIGURE 1 – Year-to-Date 2023 versus Full-Year 2022 Comparative Performance

BondBloxx 2024 Outlook

A Year of Resilience Presents New Opportunities

Our base case view is that the U.S. economy will continue to demonstrate resilience in today’s higher interest rate environment, although it may experience a modest economic slowdown in the coming year. We do not see the current higher interest rate environment as overly restrictive in terms of its economic impact, but instead view current rates as a return to a more normal interest rate environment. In our opinion, the period of abnormally low rates was during the Fed’s lengthy quantitative easing period between 2009 and 2021.

In terms of our downside view, we could foresee a more pronounced economic slowdown next year in the U.S. if the cumulative impact of higher rates or an exogeneous event lowers GDP growth rates below expectations. However, even in this downside scenario, we do not foresee a recession in 2024. Rising geopolitical concerns could also increase downside risks for the U.S. economy and for the financial markets. Specifically, an escalation of war in Ukraine or the Middle East, leading to sharp supply disruptions in commodities such as oil and natural gas, or a disruption in global shipping could adversely impact global economic health or trends in inflation.

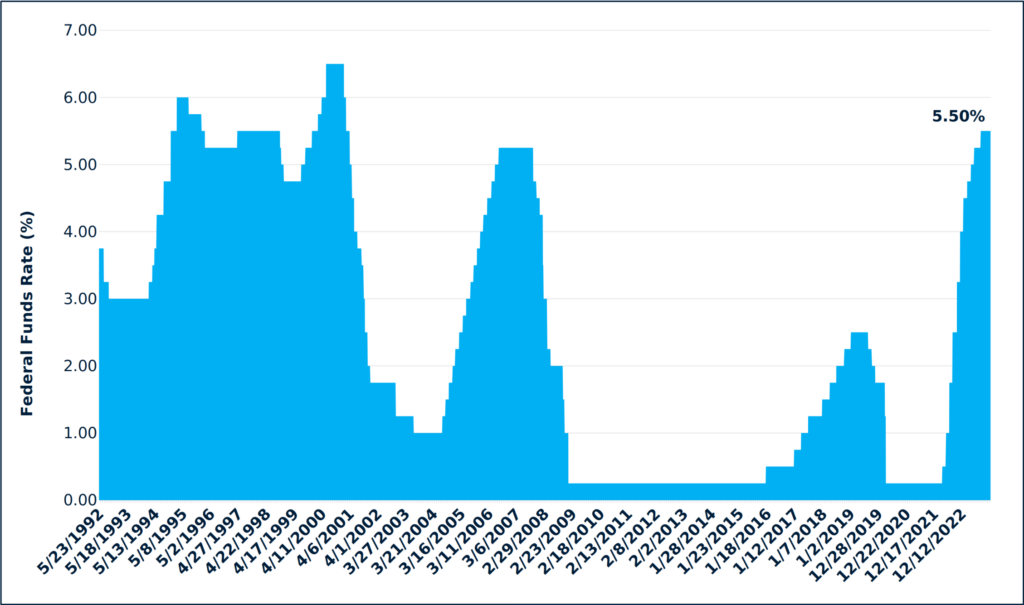

Regarding Fed policy, after 11 hikes for a cumulative 525 basis points since the first quarter of 2022, we believe the Fed is likely done raising rates for this cycle (Figure 2). However, there is a chance the Fed could raise rates again in 2024 if the progress in controlling inflation should stall or persist in the low 3% range. We also think the Fed will maintain an elevated federal funds rate longer than market consensus, potentially only cutting rates once or twice starting mid-next year.

Our constructive view on investing in select areas of the fixed income market is supported by resilience that continues to be evident across a variety of economic indicators:

- The U.S. unemployment rate remains near historic lows at 3.9% and the jobs market remains strong, despite modest softening of both metrics over the past year.

- Stability in inflation-adjusted retail sales statistics indicate that consumers are still spending, which is supportive of the continued growth in GDP.

- Corporate balance sheets across investment grade and high yield appear to remain generally well-positioned to manage the potential for softening economic conditions.

- We believe that although U.S. high yield defaults could peak slightly above the long-term average of 4% in the coming year, the BB-rated bias of near-term debt maturities and the resilient starting fundamentals for the asset class should prevent a more severe default cycle.

FIGURE 2 – Federal Funds Rate History

Source: Bloomberg, as of 11/30/2023.

2024 Outlook by Asset Class

U.S. High Yield Corporates

High Yield Remains at the Head of the Class

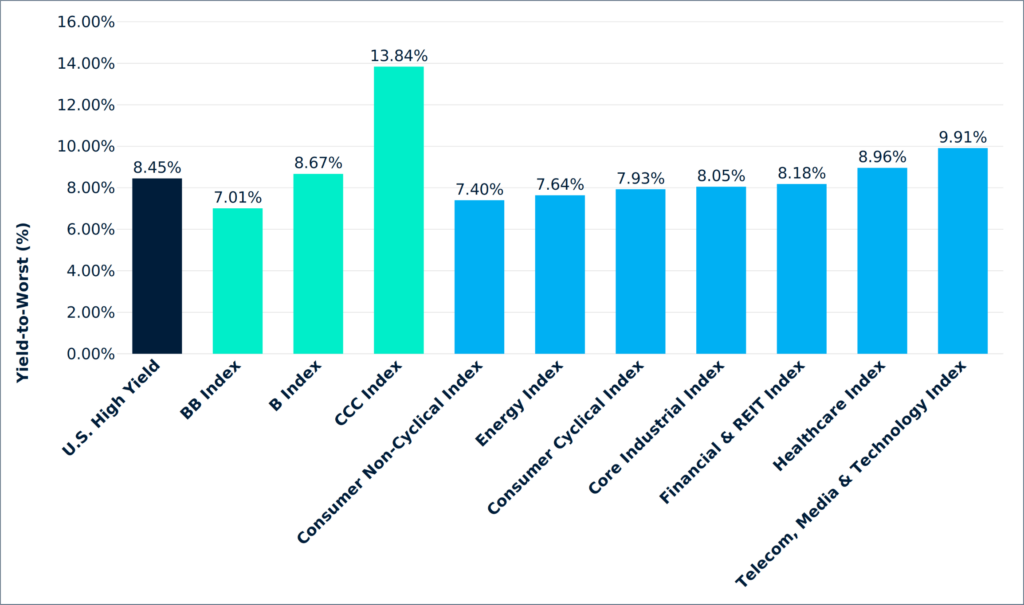

- Our view: The attractive yield levels currently available in U.S. high yield bonds can provide higher income generation potential for investors and a meaningful cushion against potential spread widening, all with lower expected volatility than equities (Figure 3).1

- Corporate fundamentals: The stronger fundamental starting point for U.S. high yield remains a clear differentiator this cycle, with average credit quality still near all-time highs. Although leverage and interest coverage measures have started to soften during the past two quarters, high yield corporate balance sheets remain generally well-positioned. Furthermore, issuers continue to actively address their near-term bond maturities, reducing the chance of a significant rise in corporate defaults.

- Performance: Return dispersion across credit rating categories and industry sectors continued in 2023. We believe this variance will continue, creating potential opportunities for outperformance versus broad high yield market indices based upon credit quality and industry sector selection.

- Investment considerations: Credit rating category positioning can help investors calibrate their high yield risk exposure, while high yield industry sector positioning can help investors express their outlook for U.S. economic conditions. Use case ideas for selected BondBloxx high yield ETFs are provided in Figure 4.

FIGURE 3 – Yield-to-Worst by Rating Category and Industry Sector

FIGURE 4 – Use Cases for BondBloxx U.S. high yield ETFs

Focus on the highest credit quality

Investors concerned about weakening U.S. economic conditions may consider investing in the high yield rating which exhibits the most balance sheet strength and the lowest historical default risk with XBB

Aim to maximize total return with high yield sector rotation strategy

Investors looking to maximize total return via an active high yield sector rotation strategy may consider HYSA

Investment Grade Corporates

BBBs are the place to be once again

- Our view: Investment grade corporate bonds are attractive, with yields that are more than double where they started in 2022. Fundamentals for the asset class continue to be strong. We are especially constructive on the BBB rating category of the U.S. corporate index, reflecting its higher average coupon income and total return potential versus the broad corporate index.

- Corporate fundamentals: BBB corporate fundamentals remain solid, with leverage statistics still below pre-pandemic levels, strong debt coverage ratios, and resilient earnings. Although there could be a softening of BBB fundamentals in 2024 if economic growth slows, we believe corporate balance sheets are well-positioned to manage through this slowdown.

- Performance: On an annualized basis, BBB’s have outperformed broad U.S. corporate indices over the past 1, 3, 5, 10 and 20 years.

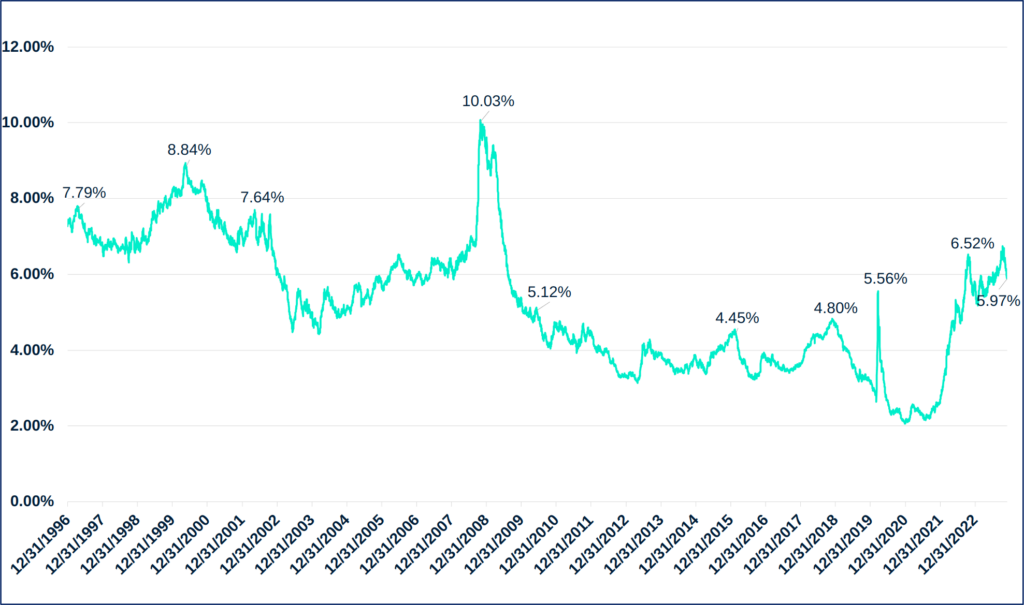

- Investment considerations: We believe investors are well-compensated for BBB risk at yields greater than 6.0%, yield levels not seen since the Great Financial Crisis (Figure 5).

FIGURE 5 – Yield History of the ICE BofA BBB Corporate Index

Source: ICE Data Services, as of 11/30/2023. Past performance is not indicative of future results. It is not possible to invest in an index.

Source: ICE Data Services, as of 11/30/2023. Past performance is not indicative of future results. It is not possible to invest in an index.

Emerging Market Sovereign Debt

The case for EM looks great, but hold the duration

- Our view: We view emerging markets sovereign debt as an attractive asset class within fixed income, reflecting its potential for spread tightening supported by resilient global economic conditions, moderating inflation, and a weakening U.S. dollar.

- Performance: Emerging markets sovereign debt funds were among the worst performers in fixed income in 2022, driven largely by interest rate movements. The asset class has generated better performance in 2023, outperforming both U.S. Treasury and investment grade corporate bond indices. However, it trailed the even stronger performance of the U.S. high yield market.

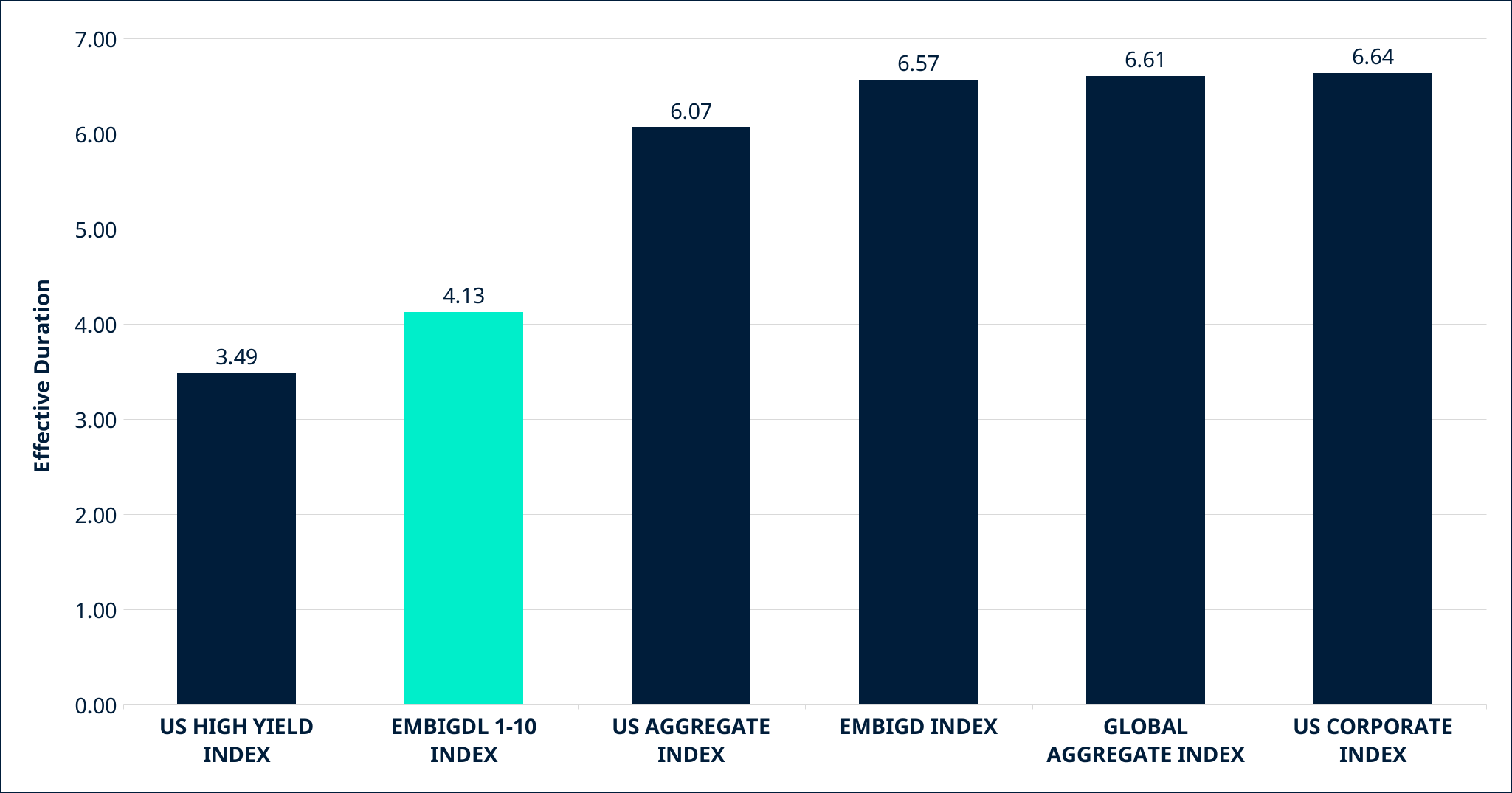

- Investment considerations: A shorter duration approach to investing in emerging markets bonds offered by BondBloxx’s XEMD ETF offers the opportunity to invest in a diversified portfolio of global issuers, reduce both interest rate and spread duration risk in the asset class, and benefit from an attractive yield.

FIGURE 6 – Duration Comparison of J.P. Morgan 1-10 Year Emerging Markets Sovereign Debt Index Versus Broad Fixed Income Indices

U.S. Treasuries

Target Short-to-Intermediate Exposure

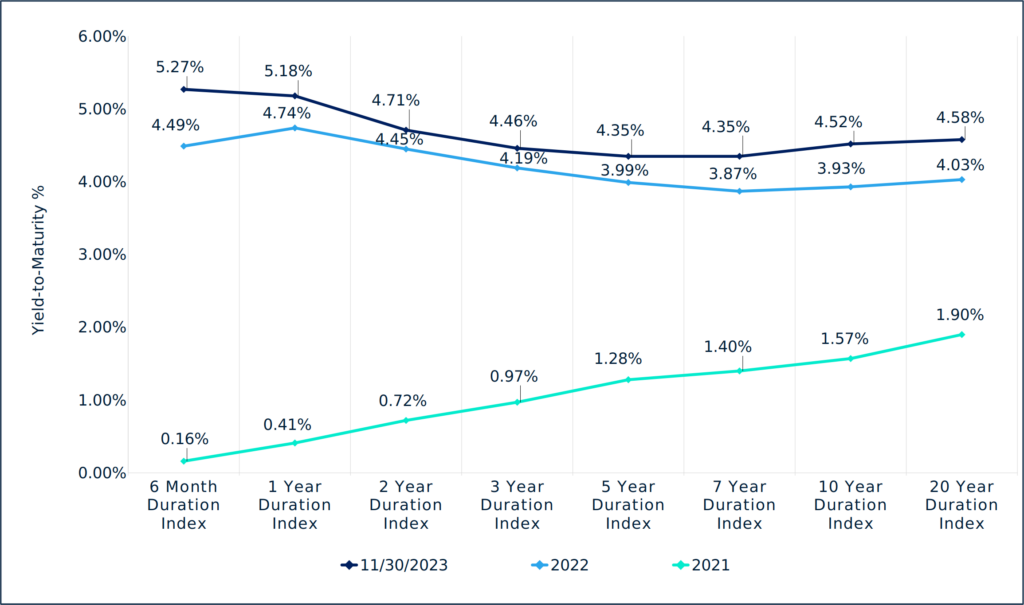

- Our view: We believe higher U.S. Treasury yields have increased the appeal of government bonds to investors, with opportunities across the yield curve dependent upon specific investment goals and risk tolerance (Figure 7).

- Performance: The shorter end of the U.S. Treasury curve experienced the best performance in 2023, generating attractive total return performance for investors with low volatility. Alternatively, the long end of the U.S. Treasury curve reported negative performance for the second year in a row as long-dated bonds remained unusually volatile, and yields ended at higher levels.

- Investment considerations: We do not anticipate any further rate hikes by the Fed in 2024. Instead, we expect the Fed will cut rates once or twice starting mid-year. This scenario would bode well for the performance of the belly of the U.S. Treasury curve next year, and we believe investors should consider extending duration to capture this potential opportunity. We also think shorter-term U.S. Treasuries remain attractive to help generate higher income, manage cash positions, and maintain liquidity. Use case ideas across the yield curve with BondBloxx U.S. Treasury ETFs are provided in Figure 8.

FIGURE 7 – U.S. Treasury Yields Across the Yield Curve

Source: Bloomberg, as of 11/30/2023. The indices represented in this chart include 8 Bloomberg U.S. Treasury Target Duration indices.

FIGURE 8 – Use Cases Across the Yield Curve With BondBloxx U.S. Treasury ETFs

Treasury Inflation-Protected Securities

Capture 14-Year Highs in Real Yields

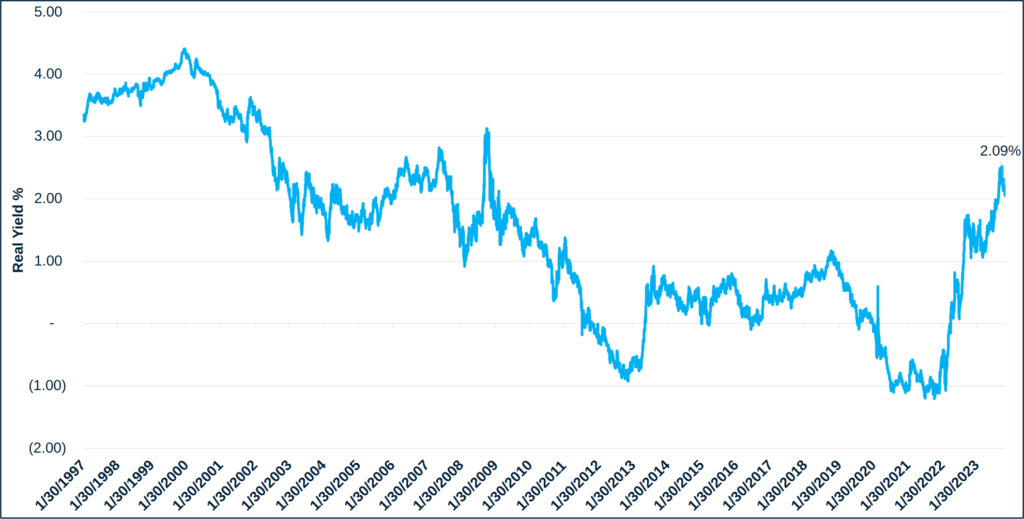

- Our view: With real yields back to 14-year highs across most developed markets, global inflation-linked securities appear attractive in terms of their total return potential in the coming year and also as a diversified hedge against global inflation. Figure 9 illustrates the upward trend in real yields for the U.S. TIPs market.

- Performance: Performance of inflation-linked securities lagged in 2023 compared to other broad fixed income asset classes, as the real interest rates of most developed markets continued their upward trend.

- Investment considerations: With the potential end to rate hikes across most developed markets in 2024, global inflation-linked securities may generate attractive total return performance in the year ahead.

FIGURE 9 – Bloomberg U.S. 10-Year Real Yield Index

Source: Bloomberg, as of 11/30/2023.

Source: Bloomberg, as of 11/30/2023.

Key takeaways

Let Fixed Income Do More For You

We believe opportunities exist across the fixed income landscape, with yields in most sectors at decade highs and an economic environment that remains resilient. The potential for increased performance dispersion within asset classes means that investors will be well-served looking beyond broad-based benchmarks to the ratings, sectors, and duration categories that benefit from the current economic cycle and Fed policy.

Glossary and Index Definitions

- Basis Point is a standardized measure to denote a percentage change in interest rates, spreads, or other financial metrics. 1 basis point is equivalent to one-hundredth of a percentage point (0.01%).

- Below investment grade bonds: Bonds that are deemed speculative. According to the S&P Global Ratings, these bonds are rated ‘BB’, ‘B’, ‘CCC’, ‘CC’, and ‘C’ where ‘BB’ indicates the least degree of speculation and ‘C’ the highest.

- The Bloomberg Global-Aggregate Total Return Index is a flagship measure of global investment grade debt from twenty-eight local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

- The Bloomberg U.S. 10-Year Real Yield Index is an index of 10-year U.S. Treasury inflation-linked securities.

- The Bloomberg U.S. Aggregate Index is broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed rate pass-throughs), ABS and CMBS (agency and non-agency).

- The Bloomberg U.S. Treasury Target Duration Indices are a suite of 8 indices designed to target a specific duration using US Treasury securities. The 8 durations targeted are 6 Month, 1 Year, 2 Year, 3 Year, 5 Year, 7 Year, 10 Year and 20 Year.

- The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

- Duration is the risk associated with the sensitivity of a bond’s price to a one percent change in interest rates. The higher the duration, the more sensitive a bond investment will be to changes in interest rates. Duration management is important for optimizing investment returns, managing risk, and ensuring that a portfolio aligns with an investor’s financial objectives and risk tolerance.

- The Federal Funds Rate is the is the interest rate that U.S. banks charge one another to borrow or lend money overnight.

- The ICE BofA BBB US Corporate Index is a subset of the ICE BofA US Corporate Index including all securities rated BBB1 through BBB3, inclusive.

- The ICE BofA Broad Market Index measures the performance of U.S. dollar-denominated, investment grade debt securities, including U.S. Treasury notes and bonds, quasi-government securities, corporate securities, residential and commercial mortgage-backed securities and asset-backed securities.

- The ICE BofA Current 10-year U.S. Treasury Index is a one-security index comprised of the most recently issued 10-year U.S. Treasury note.

- The ICE BofA U.S. Corporate Index tracks the performance of U.S. dollar-denominated investment grade rated corporate debt publicly issued in the U.S. domestic market.

- The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated, below investment grade-rated corporate debt publicly issued in the U.S. domestic market.

- The ICE BofA U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market.

- The ICE Diversified U.S. Cash Pay High Yield Rating Category Indices contain all securities in the ICE BofA U.S. Cash Pay High Yield Index, broken down by their rating categories: BB1-BB3, B1-B3, and CCC1-CCC3. Index constituents are capitalization-weighted, based on their current amount outstanding.

- The ICE Diversified U.S. Cash Pay High Yield Sector Category Indices contain all securities in the ICE BofA U.S. Cash Pay High Yield Index, broken down by industry including: Industrials; Telecom, Media & Technology; Healthcare; Financial & REIT; Energy; Consumer Cyclicals; Consumer Non-Cyclicals. Index constituents are capitalization-weighted, based on their current amount outstanding.

- Investment grade bonds: Bonds that are deemed to have a lower risk of default. According to the S&P Global Ratings, these bonds are rated ‘AAA’, ‘AA’, ‘A’, and ‘BBB’, where ‘AAA’ indicates the highest capacity for the bond issuer to meet its financial obligation.

- The J.P. Morgan 1-10 Year Emerging Markets Sovereign Index tracks liquid, U.S. dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi sovereign entities. The EMBIGDL 1-10 Index is based on the long-established J.P. Morgan EMBI Global Diversified Index and follows it methodology closely, but only includes securities with at least $1 billion in face amount outstanding and average life below 10 years.

- The J.P. Morgan EMBI Global Diversified Index tracks total returns for traded external debt instruments in the emerging markets, including U.S. dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million.

- Market volatility represents variance in returns for a given security of market.

- Spread Duration is the sensitivity of a bond or portfolio’s market price to a change in its option-adjusted spread (OAS).

- The yield curve is a line chart that plots interest rates of bonds that have equal credit quality but differing maturity dates.

- Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity.

- Yield to Worst (YTW) is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

1 As of 12/31/22, the 10-year average standard deviation of returns for the S&P 500 Index was 17% while the ICE BofA U.S. High Yield Index was 9%. We expect equities to continue to exhibit higher volatility compared to high yield bonds. Standard deviation measures the dispersion of a dataset relative to its mean (average) and is often used as a measure of relative risk of an asset. A high standard deviation indicates a more volatile security. The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated, below investment grade-rated corporate debt publicly issued in the U.S. domestic market.

Disclosures

Carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus or, if available, the summary prospectus, which may be obtained by visiting BondBloxxETF.com. Read the prospectus carefully before investing.

This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The views expressed herein are subject to change and do not constitute investment advice or a recommendation regarding any specific product or security. Past performance is no guarantee of future results. Investing involves risk including possible loss of principal.

Investments in fixed income securities are subject to risks including but not limited to interest rate risk, credit risk and market risk, each of which could have a negative impact on the value of the holding. Credit risk refers to the possibility that the issuer or other obligor of a security will not be able or willing to make payments of interest and principal when due. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

U.S. Treasury obligations may differ from other securities in their interest rates, maturities, times of issuance and other characteristics and may provide relatively lower returns than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund’s U.S. Treasury obligations to decline. While U.S. Treasury obligations are backed by the “full faith and credit” of the U.S. Government, such securities are nonetheless subject to credit risk.

Securities that are rated below investment-grade (sometimes referred to as “junk bonds,” which may include those bonds rated below “BBB-” by S&P Global Ratings and Fitch or below “Baa3” by Moody’s), or similar securities that are unrated, may be deemed speculative, may involve greater levels of risk than higher-rated securities of similar maturity and may be more likely to default.

Investing in emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets; Loss due to foreign currency fluctuations, or geographic events that adversely impact issuers of foreign securities.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by BondBloxx. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by BondBloxx or any other person. While such sources are believed to be reliable, BondBloxx does not assume any responsibility for the accuracy or completeness of such information. BondBloxx does not undertake any obligation to update the information contained herein as of any future date.

Distributor: Foreside Fund Services, LLC.